```markdown

Is It Possible?: How to find someone's net worth online free [Guide] + Ethical Checks

Curious about discovering someone's financial standing without spending a dime? This guide, "[Is It Possible?: How to find someone's net worth online free [Guide] + Ethical Checks]," offers practical methods to estimate net worth using publicly accessible data. We'll delve into background checks and net worth research, highlighting common errors in online estimations. Critically, we'll emphasize legal and ethical boundaries, teaching you how to interpret public records while avoiding misleading appearances. Our focus is on reliable data and the evolving landscape of financial transparency. Let's explore net worth assessment responsibly, understanding its importance and implications. Learn more about prominent figures, such as Tom Maoli's net worth.

How to Find Someone's Net Worth Online Free: A Comprehensive Guide

Want to know someone's financial situation? Whether considering a business partnership or simply curious, discovering a person's financial resources online for free requires caution. Like navigating a tightrope, privacy, and legal limits must be respected. Let's explore how to find someone's net worth online for free, emphasizing considerations before beginning your search.

The Fundamentals of Calculating Net Worth

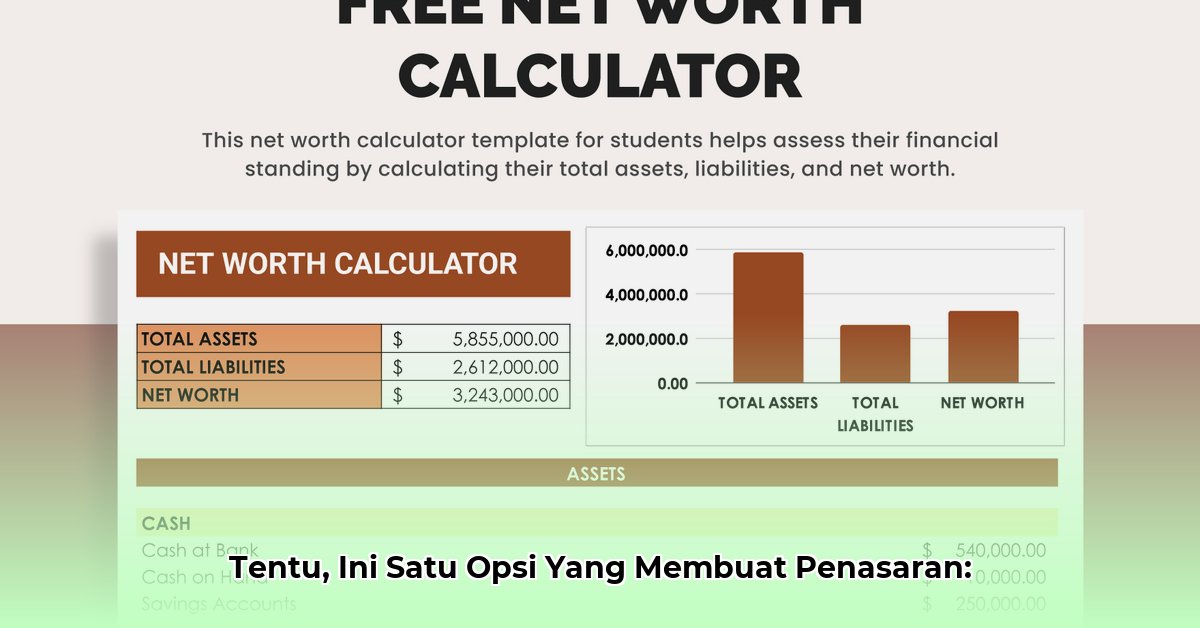

Net worth represents total assets minus liabilities. On one side, list assets like houses, vehicles, investments, and savings. On the other, list liabilities like mortgages, student loans, and credit card balances. Subtract liabilities from assets to determine net worth. Understanding this calculation is the first step in net worth estimation.

Different Methods for Estimating Net Worth

Calculating someone's exact net worth without their consent is impossible. Instead, we gather clues and make educated guesses using public records, online tools, and lifestyle indicators. This process resembles assembling a puzzle; more pieces clarify the picture, but a complete image is rare. The challenge is to estimate someone's wealth accurately with incomplete information.

How to Explore Public Records

Public records offer surprisingly rich data, legally accessible insights into assets and business dealings. While valuable, sifting through these records requires time and effort. Learning how to access and interpret such records is crucial to financial background checks.

- Property Records Access: Begin with the local county assessor's website to find information on property ownership, assessed values, and sales history. This provides insights into real estate holdings. Be cautious of relying solely on assessed values.

- Vehicle Registrations Simplified: Knowing the type and number of vehicles someone owns offers clues about their financial status, although someone might lease rather than own vehicles, complicating asset verification.

- Business Filings Unveiled: If the person owns a business, state databases or the Secretary of State's website can reveal business structure, ownership, and potential assets, enhancing business valuation insights.

How to Use Online Tools

Numerous websites claim to estimate net worth. Approach these tools cautiously, as their algorithms and incomplete data can produce significantly inaccurate results. Consider them rough estimates rather than precise calculations. What are the limitations of free net worth calculators?

- Net Worth Calculators Utilized: These tools estimate net worth based on inputted asset and liability data. Accuracy depends entirely on the data's quality and completeness.

- People Search Engines Examined: Some people search engines aggregate public data and estimate net worth. However, the accuracy of these estimates varies widely depending on data sources. Understanding these data source limitations is essential for comprehensive financial profiling.

How to Interpret Lifestyle Clues

Lifestyle observation is the most unreliable method. Inferring wealth from homes, cars, clothing, and vacations can be deceiving. Appearances can obscure true financial situations. How can you avoid misinterpreting lifestyle analysis?

Someone might lease a fancy sports car or buy designer clothes on credit. Misinterpreting lifestyle is easy, and appearances don't always reflect actual wealth.

Pros and Cons of Each Method

Here's a breakdown of the pros and cons of each approach to help you weigh their effectiveness:

| Method | Pros | Cons |

|---|---|---|

| Public Records | Verifiable data, fairly accurate for specific assets | Time-consuming, provides only an incomplete picture of overall finances |

| Online Tools | Fast and easy, offers a broad estimate without specific information | Often inaccurate, relies on incomplete data, can be misleading; Privacy concerns |

| Lifestyle Clues | Easily observed, requires no special tools | Highly unreliable, prone to misinterpretation, doesn't reflect actual finances, opens possibilities for judgmental analysis |

Navigating Ethical Issues with Caution

Before searching, consider the ethical implications. Are you invading someone's privacy? How will you use the information? Is knowing this information truly necessary? The importance of ethical considerations in financial information gathering cannot be overstated.

Always respect legal boundaries and privacy laws. Just because you can do something doesn't mean you should. Seeking financial information without consent can damage relationships and erode trust. "Respecting someone’s financial privacy is paramount, even when data is technically accessible. Consider the potential harm before you search," said [Dr. Emily Carter, Ethics Professor], [Professor] at [University of Ethical Studies].

Actionable Steps for Responsible Use

Here are actionable steps to navigate this process responsibly:

- Prioritize Ethics: Seriously consider the ethical and legal implications before starting your search.

- Start with Public Records First: Begin research with publicly available records, providing a fair starting point.

- Cross-Reference Diligently: Verify all information with multiple sources to ensure accuracy and avoid misleading data.

- Consult Professionals When Needed: Consult a legal professional to ensure compliance with all applicable privacy laws.

Looking at the Big Picture

Develop a personal code of ethics regarding financial information. Advocate for financial transparency where appropriate, always prioritizing responsible data handling and respect for privacy. Cultivating responsible financial ethics is crucial in digital research.

A Note of Caution

Estimating someone's net worth is not precise. Online estimates carry a significant margin of error, often plus or minus 5%. Handle information carefully, avoiding assumptions or judgments based on incomplete data. It’s about understanding, not judging. The need for caution in financial assessment cannot be overemphasized, given the potential for inaccuracies.

Decoding Dollars and Cents: Navigating the Net Worth Maze

Key Insights:

- Determining someone's net worth involves financial knowledge and investigational capabilities.

- Public records, online tools, and lifestyle cues can offer insight, but accuracy is never guaranteed.

- Ethical considerations are paramount; carefully navigate legal pitfalls.

- For critical partnerships or investments, professional financial analysis is essential.

- Openness before agreements is paramount to avoid potential losses or schemes.

Estimating financial well-being can feel like deciphering a complex code. Is it possible to uncover net worth without becoming a financial stalker? Let's explore the domain of net worth discovery, differentiating reality from fiction and keeping integrity intact.

Unveiling Financial Footprints: Public Records as Breadcrumbs

Envision public records as indicators along a monetary path. These records, accessible openly, can uncover valuable information that aids in wealth estimation.

- Details on Property Ownership: County assessor websites are mines of significant details. They list property possessors and evaluated valuations. Remember that evaluated valuation isn't always market valuation, but it's a reliable departure point.

- Simplified Vehicle Registrations: While you won't uncover bank account details, vehicle registrations can point out the variety and valuation of vehicles possessed. An array of lavish vehicles might signify a larger net worth, or simply a fondness for costly vehicles and substantial liability.

Just because someone has a lavish residence doesn't mean they're loaded. They might have a hefty mortgage!

Digital Detective Work: Online Tools and Their Limitations

The internet presents a plethora of tools declaring to estimate net worth. But are they genuine?

- Estimator Websites Analyzed: Pages like Celebrity Net Worth or Forbes provide estimations, but treat these figures with skepticism. They're frequently based on openly available information and premises, not inside expertise.

- Social Media Reconnaissance Examined: While appealing, media sleuthing is rarely precise. Remember, individuals arrange their online personas, frequently showcasing an idealized interpretation of truth.

View these tools as providing you a generalized valuation rather than a precise measuring.

Lifestyle Analysis: Reading Between the Lines (Carefully!)

Observing someone's lifestyle can reveal signs, but it’s subjective and easily misinterpreted. A lavish lifestyle doesn't always correlate to wealth; it could signify liability or simply distinctive priorities. What biases affect wealth interpretation based on lifestyle?

Consider these observations with a grain of salt:

- Spending Habits Analyzed: Regular costly acquisitions could propose considerable expendable income, but they might also be financed by credit cards or lending.

- Travel Patterns Decoded: Significant travel might suggest affluence, but it could also be a result of meticulous budgeting and travel hacking.

Ultimately, lifestyle analysis is more about collecting context than definitive evidence.

The Ethical Compass: Steering Clear of Trouble

Before you launch this adventure, consider the ethical implications. Are you motivated by authentic concerns or sheer concern? Is it genuinely required to verify wealth? What are the repercussions of financial snooping?

Here are a few ethical guidelines:

- Protect Privacy: